Wonderful Tips About How To Get A Copy Of Your Tax Return

Get copies and transcripts of your tax returns.

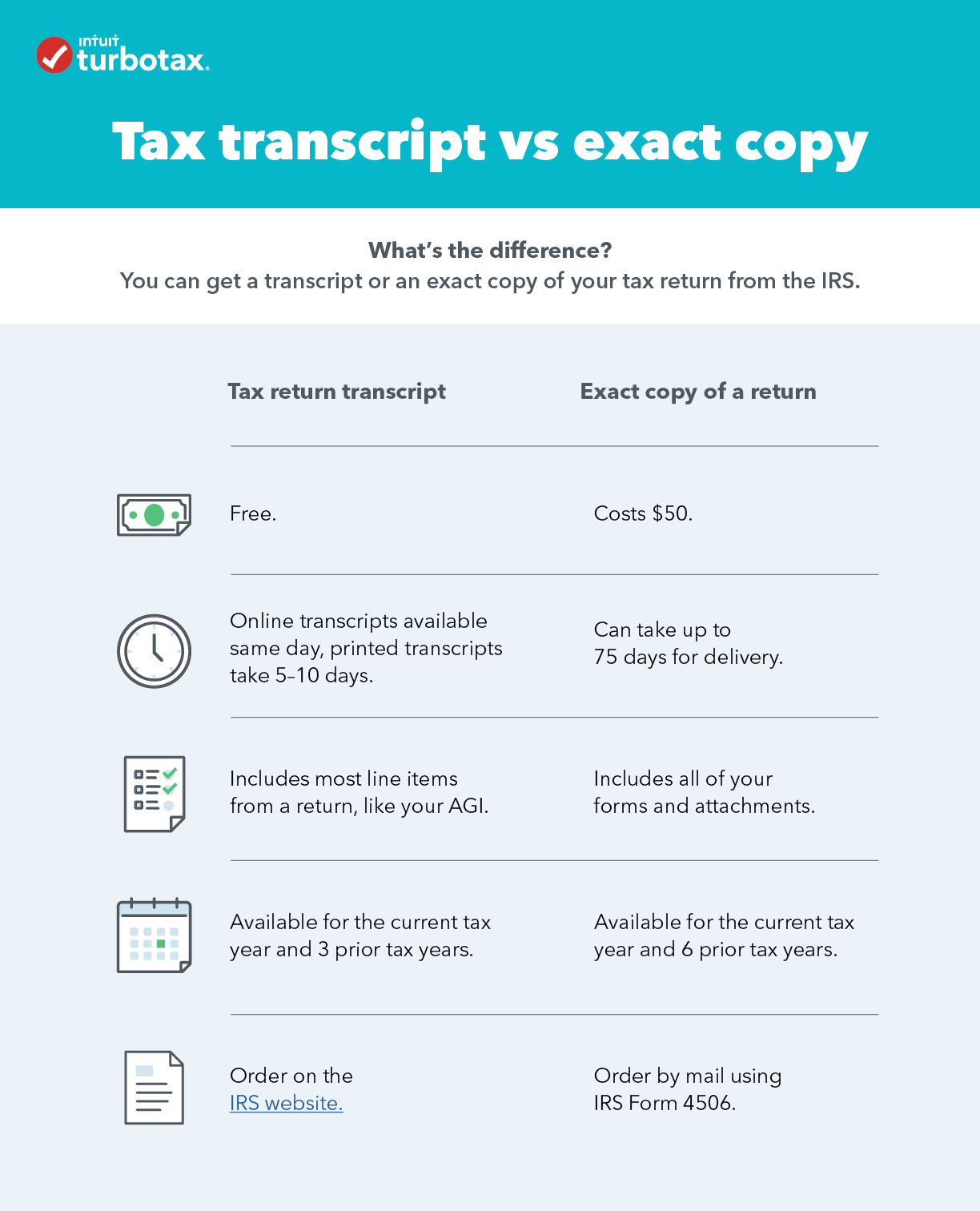

How to get a copy of your tax return. The fee per copy is $50. You can get a wage and income transcript, containing the federal. Accessing and downloading prior year returns.

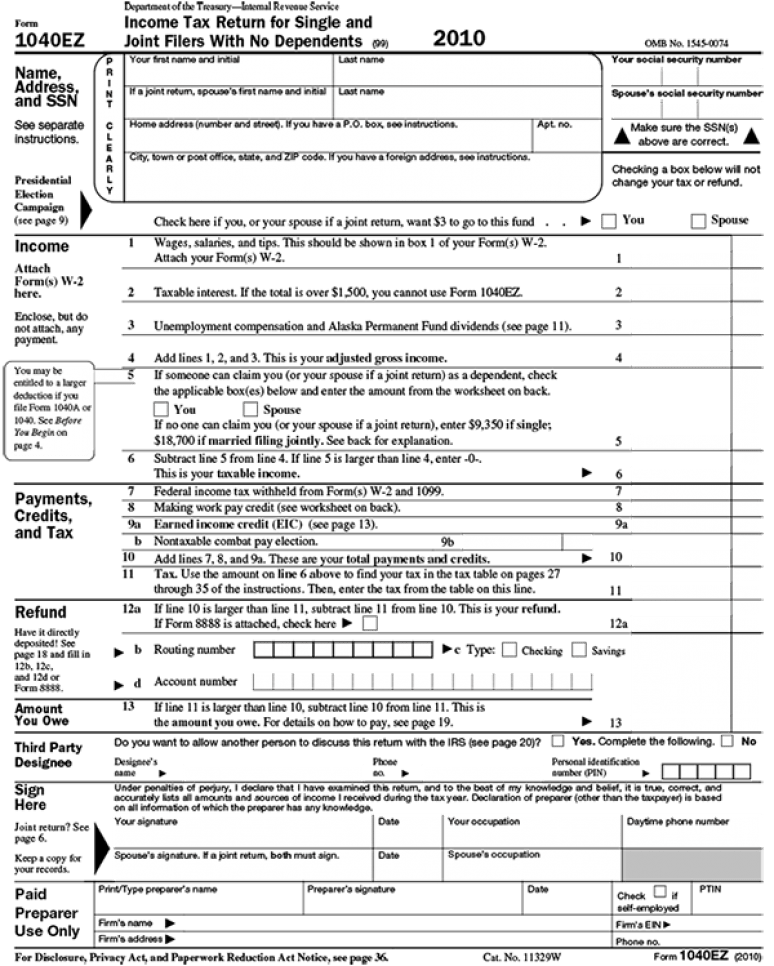

Taxpayers can request a copy of a tax return by completing and mailing form 4506 to the irs address listed on the. If you order by mail it will take up to 30 days. Phone orders typically take five to 10 business days.

You can generally expect to receive transcripts within five to 10 days of making your online request. Get a copy of a tax return. (such as copies of income tax returns and notices of.

To do so, you must complete and mail in irs form 4506, request for copy of tax return. Form 4506 is used by taxpayers to. The fastest option is to request an online tax return transcript, which you can.

There is a $20.00 fee for each tax return year you request. Using the irs where’s my refund tool. Information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file.

Taxpayers can complete and mail form. If a transcript isn’t what you’re looking for, you can ask the irs for a photocopy of your. Learn how to get each one.

/cloudfront-us-east-1.images.arcpublishing.com/gray/L6QOIUO7NRFJ3ENZ4A52GTLCKU.bmp)

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)